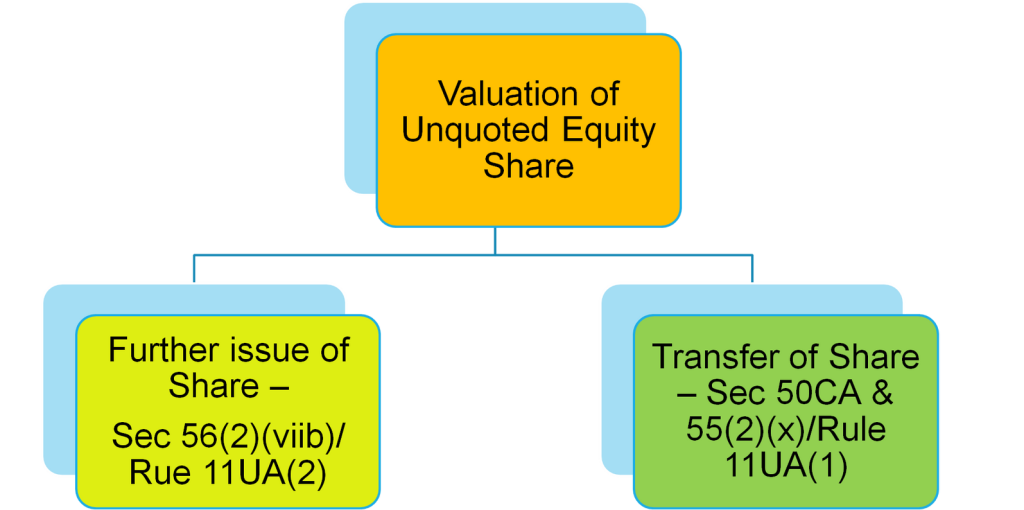

If a closely held company raises funds through the issuance of its shares to an Indian resident AT A PRICE MORE than its fair market value (FMV), then the amount received in excess of fair market value of shares will be charged to tax as an income from other sources in the hands of the issuer.

Where a company, not being a company in which the public are substantially interested, receives, in any previous year, from any person being a resident, any consideration for issue of shares that exceeds the face value of such shares, the aggregate consideration received for such shares as exceeds the fair market value of the shares:

Explanation. – For the purposes of this clause, the fair market value of the shares shall be the value—

- as may be determined in accordance with such method as may be prescribed; rule 11UA(2) or

- asmay be substantiated by the company to the satisfaction of the Assessing Officer, based on the value, on the date of issue of shares, of its assets, including intangible assets being goodwill, know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature, Whichever is higher